Note: This method no longer works as well as it did. The price protection claims process is now difficult or impossible to automate.

I buy most of my stuff on Amazon. After all, who can resist having practically anything delivered to your door, usually at a good price, within two days (or even the same day)? Consider me seduced.

But what happens when you get those shoes, TV, or even paper towels, and the price drops a month later? When you bought it for $10, but now the price is $8? Well, if you paid for it using a Chase or Citi credit card, you’re golden since there are apps that will automatically take advantage of these banks’ price protection policies to get you a refund for the price difference.

Like a free money shower

The main apps are Earny and Paribus. I’ve been using Earny for a little over six months with a Chase card; this has been my Amazon price protection experience.

Six Months With the Earny App

I signed up for Earny on April 2, 2017, and it started tracking my Amazon purchases that day. By October 8, 2017, I bought $982.68 of stuff on Amazon, across 48 purchases.

The Earny app tracked all of those buys, and requested refunds on those that were eligible (less than 10 were denied by Chase for some reason or other). In all, I’ve gotten $62.77 refunded by Chase, so far. I could still get more on these purchases, since Earny continues to track many of them. For this, Earny has billed me $14.22 so far.

Therefore, I’ve netted $48.55 thus far.That’s about 4.94% of total money spent back (after commissions to Earny), thus far. Again, this is an “at least” number, since Earny is still tracking recent purchases.

So, judging by my experience, I think it’s safe to say that Earny has a return rate, on Amazon, of 5% or greater. This is when you use a Chase card, which accepts price drop claims up to 90 days post-purchase.

Is It Worth It?

As far as my Amazon price protection experience goes, there’s been one big drawback: annoyance. (I’m not really bothered by the fact that the Earny app knows all about my purchases, since Amazon already does, plus I’ve kind of accepted that such is the way of the world now).

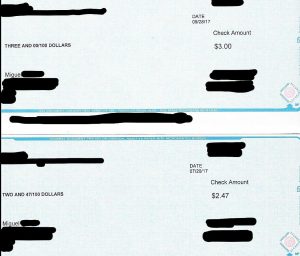

This whole process has been annoying in that the way that Chase processes price protection claims is to use a third-party company that mails you physical checks. Since most claims are for small amounts (like less than $4) I (and my wife) are constantly getting these little checks in the mail. That means that we have to endorse them and deposit them (using cellphone mobile deposit), and deal with the paper recycling issue. It’s a huge waste of time and resources on the part of Chase; I wish they would just give account credit.

Those annoying little checks!

Despite that, I know that today I have $48.55 worth of Amazon price protection, that I would not have otherwise. For me, it’s worth it, at least as long as it lasts.

What do you think of price protection apps?

Credit: GIF from Giphy

Wow those are amazing card benefits! I don’t have a Chase or Citi card as I’m in Canada, but I did just recently sign up for Amazon Prime because of the diapers! 🙂

For me, Amazon Prime is totally worth it 🙂

My Amazon Prime Rewards gets me 5% back on future Amazon purchases automatically for my Amazon purchases without having to use a third party service.

Hi JP,

Indeed it does, though I prefer to use Earny in conjunction with my Chase Freedom Unlimited card because I get the ~4.94% back through Earny, plus the 1.5 points per dollar provided by the credit card. The points are worth about 2.1 cents each, if combined with a premium Chase Ultimate Rewards-based credit card.

Cheers,

Miguel